Is the U.K. Property Market About to Crash?

There’s been a lot of chatter recently about the UK housing market and one question that we keep getting asked is…

"Is there going to be a property market crash in the UK?"

So, we thought we’d see what the people “in the know” had to say about what’s lurking on the horizon for the property industry.

It seems even the experts are divided amongst their opinions on the future outlook for the property industry, with some predicting a slow-down and fall in seemingly ever increasing property prices, others are expressing concern over an impending market crash inevitably looming on the horizon, and in complete contrast to those above some experts are expecting things to continue much as they have been for the last couple of years, with demand for property still outstripping the supply chain.

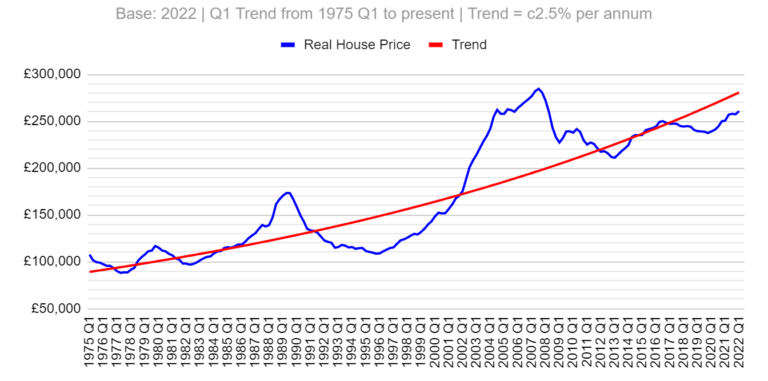

(Source: Nationwide Building Society)

“It will be in 2026, that is at the end of a 14-year cycle in house prices within a business cycle of 18 years,” said British economic commentator Fred Harrison – who accurately predicted the 2008 financial crash.

“They’ll level off for a matter of months and then they start to go down.”

“With interest rates on the rise and inflation further squeezing household budgets, it remains likely that the rate of house price growth will slow by the end of this year,”

Halifax bank’s managing director, Russell Galley.

Tim Bannister, director of property science at Rightmove, says: “It will take time for the rise in interest rates to feed through to the market, and despite further rises being a possibility this year, right now the data suggests this is not dampening the desire for people to move."

“All you really need to care about is ensuring that you could afford your mortgage if interest rates rose and also that you’re going to be happy in your new home.”

Money Week's John Stepek.

So, who should you listen to? Will we see a market crash? Will prices fall? Or does the UK’s property bubble seemingly defy gravity?

With the Bank of England hiking base lending rates to curb skyrocketing inflation, it is inevitable that mortgage costs will rise, with the average fixed rate mortgage deal already exceeding 3% for the first time in over seven years, and variable rate mortgages tracking over 4%.

Things aren’t set to improve any time soon either, with further rate increases expected later in the year. For those who are out of their initial mortgage terms.

Now could be the time to get your mortgage rate locked back in.

It’s fair to say in the short term at least we will certainly be seeing increased lending rates across the board, that itself could impact property prices which we also expect to see calming down after a historical “boom” period, however the demand appears (at least for the moment) to still be a driving factor for property prices and the South West in particular has seen some of the best conditions for sellers in many years, but these are unprecedented times we are living in and uncertainty is still very much a factor in the air, hence why the experts are completely split on this one.

Are you looking to move home currently? Not sure about your current mortgage deal? Let us find the right mortgage deal for you.

It only takes a few minutes to conduct an initial assessment of your circumstances and we’ll be able to advise you there and then, with a decision in principle being obtained, quite often on the same day!

Call Us 0333 567 3311 or Contact Us Here

Nepali Mortgages is a trading style of James Paul Beadell which is an appointed representative of The Openwork Partnership, a trading style of Openwork Limited which is authorised and regulated by the Financial Conduct Authority.

The information on this website is for use of residents of the United Kingdom only. No representations are made as to whether the information is applicable or available in any other country which may have access to it.

Approved by the Openwork Partnership on 28th May 2024